The Problem

SBA lenders know that qualifying for loan forgiveness as part of the PPP (Paycheck Protection Program) can feel like a life or death situation. And for many businesses, it is.

It is critical that borrowers understand if they’re eligible for, and how to apply for, loan forgiveness.

So, let’s ask ourselves an age-old question:

Q: How do you get your customers to read government forms?

A: You don’t

Instead, you focus on your deeper goals:

- Understanding: You want your customers to comprehend the information

- Relevance: Customers want to know what is pertinent to them

- Action: Ultimately, you want to drive people to take the optimal next step(s)

The Solution

First, we need to accept the reality that most people can not read a government form without their eyes glazing over and their minds wandering off.

Furthermore, (to state the obvious) few government documents are written in a manner that the layperson can understand.

That’s why Idomoo created an Interactive+Personalized Video to help borrowers easily understand the criteria for loan forgiveness and how to apply.

Understanding:

Human beings are primarily visual learners. By using visual metaphors and conversational language, we make the information easily digestible to everyone.

Relevance:

Personalization & Interactivity ensures the information is relevant to the individual.

Users don’t see a video, they see their video. Their name, their business name & their information eliminates the guesswork and tells them whether or not they are likely to be a good candidate for loan forgiveness.

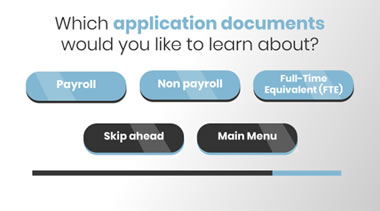

Interactivity puts them in control. Allowing the viewer to pick what they want to learn about — and not be bothered with information irrelevant to them & their business.

Action:

With increased understanding borrowers are empowered to take next steps with confidence, knowing their lender has been there to help them & their business.

For the lender, call reduction dramatically goes down & customer satisfaction soars as customers feel informed and cared for.

How we help:

As government rules continue to change rapidly, we see the need for increased agility. Idomoo builds videos dynamically, allowing for quick changes as information evolves.

Branded videos are launched in as quickly as 2 weeks, and the dynamic nature of Idomoo videos makes post-launch updates fast & easy.

In these historic times, communication methods have been forced to rapidly evolve. To keep up with consumer demand for advancements in digital services, we need to stay ahead of the curve by delivering digital communication that is relevant, engaging, and helpful. That’s why using Idomoo’s Interactive+Personalized Video technology has never been more applicable — contact us today to see why today’s top lenders are already using Idomoo, and let us help launch you into the next generation of digital communications.

To learn more about what Personalized Video can do for your business, click below.